The Purpose of this Website

This website is designed to advance our mission of mobilising trillions of dollars in support of the energy transition. It serves as a hub for deep, objective investment insights and as a meeting place for a community of investors who can both contribute their expertise and channel the capital needed to drive the energy transition

Our Community

True North Institute serves two primary audiences:

- Chief Investment Officers (CIOs) of the world’s capital owners — including sovereign wealth funds, pension plans, endowments, foundations, and family offices, both large and small.

- Investors driving the global energy transition — the specialist teams within those same institutions, as well as asset managers across public equities, venture capital, private equity, and infrastructure.

Featured Research

Here we feature a selection of the True North Institute's most important and influential research for both communities – Institutional CIOs and energy transition investors.

Evaluating First of a Kind (FOAK) Investment Performance of 25 Leading Climate Investors

This report evaluates the performance of First-of-a-Kind (FOAK) climate-infrastructure projects backed by a curated alliance of 25 leading climate-tech investors who are part of the All Aboard Fund Co-investment Network. From a dataset of 70 FOAK or FOAK-adjacent financings since 2014, the analysis identifies 16 FOAK rounds where three or more of these 25…

Analysis of Large US University Endowment Outperformance

This paper is an update two years on from our whitepaper entitled “Analysis of Large US University Endowment Outperformance” covering the 10-year period ending June 2023 of a select group of 12 US university endowments. This update covers the 10-year period ending June 2025. We have made one small change to the methodology and that is…

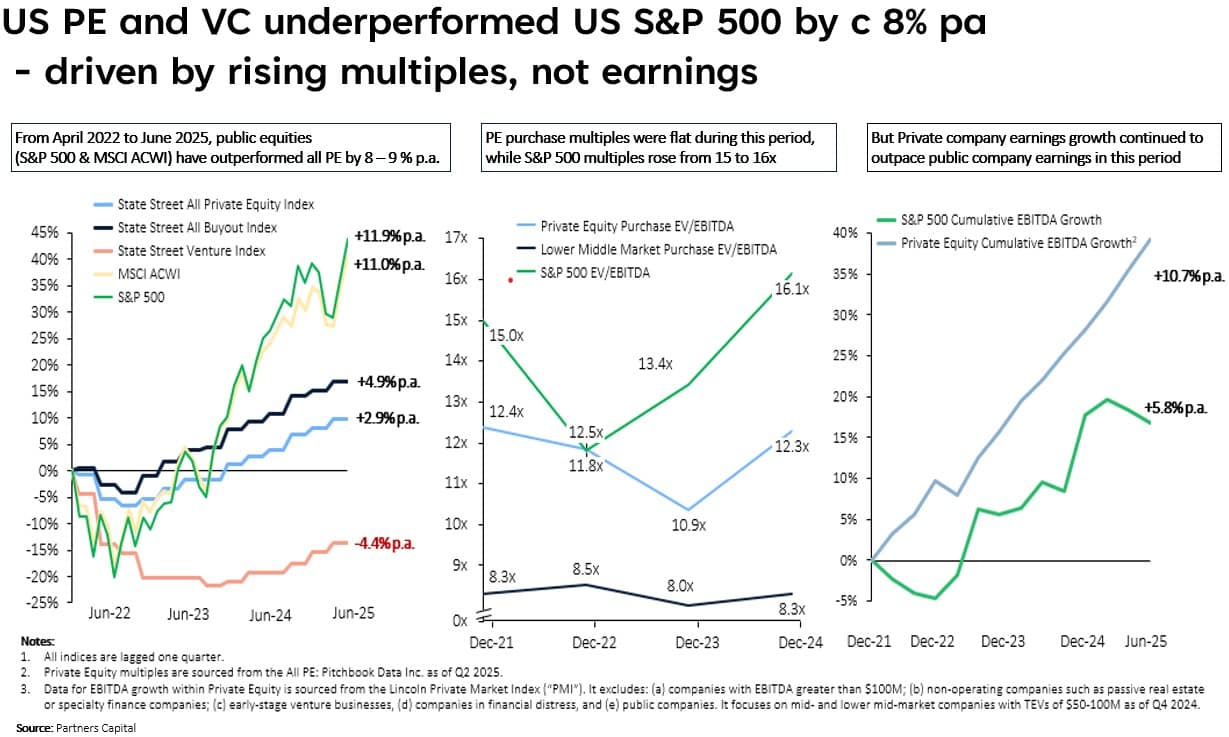

Chart of the Month

Most institutional investors today are concerned about what the future holds for private equity. Part of the answer is embedded in what explains the underperformance over the last 3 years. This simple analysis indicates that earnings growth for lower middle market companies with TEV’s between $50M to $100M has been in line with historical averages of around 11% p.a., well above the S&P500 earnings growth (chart on right). The lag in overall PE and VC performance is likely due to the fact that public equity valuations (market multiples) have risen more than private company multiples.