The Purpose of this Website

This website is designed to advance our mission of mobilising trillions of dollars in support of the energy transition. It serves as a hub for deep, objective investment insights and as a meeting place for a community of investors who can both contribute their expertise and channel the capital needed to drive the energy transition

Our Community

True North Institute serves two primary audiences:

- Chief Investment Officers (CIOs) of the world’s capital owners — including sovereign wealth funds, pension plans, endowments, foundations, and family offices, both large and small.

- Investors driving the global energy transition — the specialist teams within those same institutions, as well as asset managers across public equities, venture capital, private equity, and infrastructure.

Featured Research

Here we feature a selection of the True North Institute's most important and influential research for both communities – Institutional CIOs and energy transition investors.

Evaluating First of a Kind (FOAK) Investment Performance of 25 Leading Climate Investors

This report evaluates the performance of First-of-a-Kind (FOAK) climate-infrastructure projects backed by a curated alliance of 25 leading climate-tech investors who are part of the All Aboard Fund Co-investment Network. From a dataset of 70 FOAK or FOAK-adjacent financings since 2014, the analysis identifies 16 FOAK rounds where three or more of these 25…

Analysis of Large US University Endowment Outperformance – November 2025 Update

This paper is an update two years on from our whitepaper entitled “Analysis of Large US University Endowment Outperformance” covering the 10-year period ending June 2023 of a select group of 12 US university endowments. This update covers the 10-year period ending June 2025. We have made one small change to the methodology and that is…

Chart of the Month

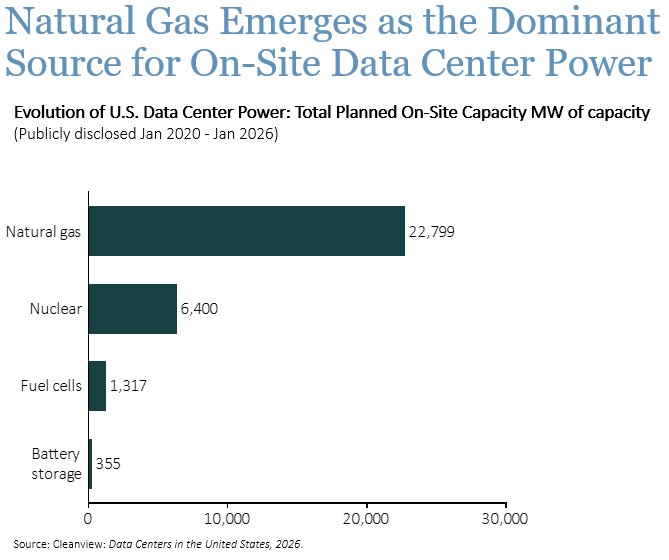

Natural Gas Emerges as the Dominant Source for On-Site Data Center Power:

Accelerating shift toward self-generation: ~30% of planned U.S. data center capacity now features behind-the-meter power in order to bypass 5–10 year grid interconnection queues, up from ~0% a year ago.

Natural gas emerges as the primary fuel: Natural gas accounts for ~75% of planned capacity, creating a structural infrastructure "lock-in" for the next 20–30 years.

Significant tailwinds for equipment manufacturers: Surging demand has fueled triple-digit stock performance over the last 12 months for natural gas turbine and fuel cell leaders like Bloom Energy (+507%), Siemens Energy (+165%), and GE Vernova (+103%).

Other investment implications may include enlarged carbon offset purchases and markets as most of the hyperscalers have net-zero commitments and natural gas emissions will tally up to large offset requirements.