RESEARCH

Beyond the Endowment Model

This whitepaper explores the potential obsolescence of the endowment model, particularly for endowments and foundations. The paper examines the historical performance of the endowment model, noting the significant role of private equity and venture capital in its success. However, due to factors such as increased competition and higher interest rates, the future prospects for these asset classes are less certain.

The whitepaper explores alternative investment models including:

- The Canadian model

- The MIO Portable Alpha model

- The Total Portfolio Approach

- Various private markets-focused models

Key Arguments and Conclusions:

Endowment model performance: Over the past decade, a group of 12 top US endowments generated average annual returns between 8.1% and 11.5%, outperforming various benchmarks. This outperformance is largely attributed to significant allocations to private equity, particularly venture capital.

Future of private equity: The paper predicts a potential decline in future returns from private equity and venture capital, primarily due to higher interest rates and decreased multiple expansion. Despite this, private company ownership is still viewed as a superior model compared to public ownership due to better management alignment and value addition capabilities of private equity firms.

Alternative models: The whitepaper examines alternative investment models, highlighting the strengths and weaknesses of each. For instance, the Canadian model, which emphasises direct internal team investing, might have achieved better results by outsourcing to third-party PE and VC firms. The MIO Portable Alpha model, while demonstrating strong performance, presents challenges in terms of complexity and execution risk.

Adapting to a changing world: The paper acknowledges the changing global landscape, marked by factors like deglobalisation, technological disruption, and geopolitical risks, as highlighted by Australia’s Future Fund. While historical data suggests that geopolitical events generally don’t have a lasting impact on financial markets, the paper questions whether current geopolitical risks warrant adjustments to investment strategies.

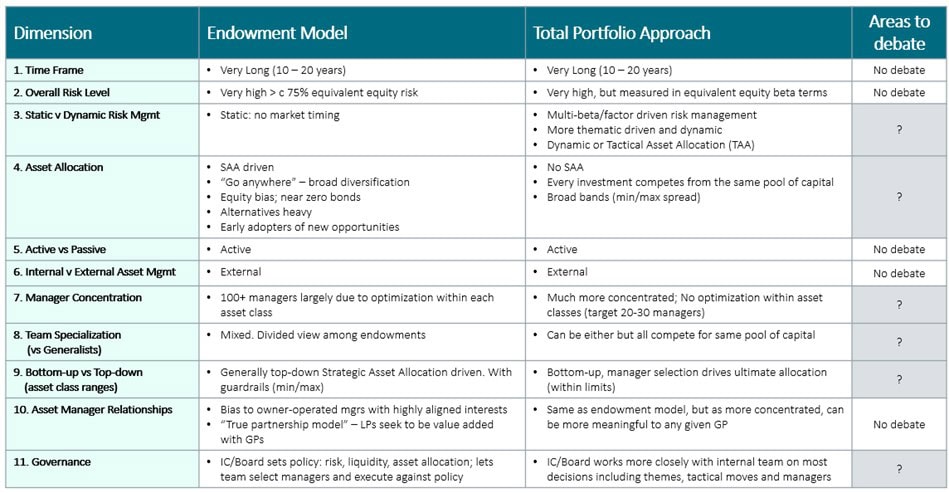

Key dimensions for a better model: The paper identifies eleven key dimensions of investment strategy, including time frame, overall risk level, asset allocation, and governance. It encourages a debate on these dimensions, particularly focusing on differences between the endowment model and the Total Portfolio Approach.

Alternative portfolio options: The paper proposes three alternative portfolio options for consideration beyond the endowment model and the Total Portfolio Approach

- Private and Public Equity-Only Model: Focus on high-risk, high-return private and public equities, with a heavy emphasis on fee-free co-investments in private equity

- Diversified Private Markets Model: Diversify illiquid asset holdings across various private market asset classes, including private equity, venture capital, real estate, and private credit

- High Risk Liquid Asset Class Strategy: Reduce private market allocation and invest in higher-risk liquid assets like high-growth equities, liquid credit, and potentially leveraged hedge funds

Enduring investment principles: Despite the evolving investment landscape, the paper underscores the continued relevance of core investment principles, such as the advantages of long-term investing, exploiting market inefficiencies, and the benefits of diversification.

Need for adaptation: The paper concludes that while the endowment model may not be entirely obsolete, it needs to adapt to the changing market conditions and the evolving landscape of private equity and venture capital. It suggests incorporating elements from the Total Portfolio Approach, such as a more concentrated manager line-up and beta/factor-based risk measurement, into the endowment model.

Tailoring the model to different investors: The paper acknowledges that the optimal investment model varies for different types of institutional investors, such as sovereign wealth funds, pensions, and family offices. It highlights the challenges faced by larger institutions seeking high allocations to private markets and suggests a focus on uncorrelated long-term return streams and identifying high-growth sub-asset classes within liquid markets