Disappearing Alpha

“Alpha is becoming more difficult to generate for even the most capable of institutional investors.”

That’s the conclusion from new analysis produced by the True North Institute, a think tank launched today by Partners Capital founder Stan Miranda. Miranda and research director David Hurdle (former CIO of family office Eagle Advisors) examined a cohort of 12 relatively large, best-in-class university endowments to determine the current trends in overall alpha, as well as outperformance within private markets.

Those 12 are Brown, Columbia, Cornell, Dartmouth, Harvard, MIT, Notre Dame, UPenn, Princeton, Stanford, University of Virginia, and Yale.

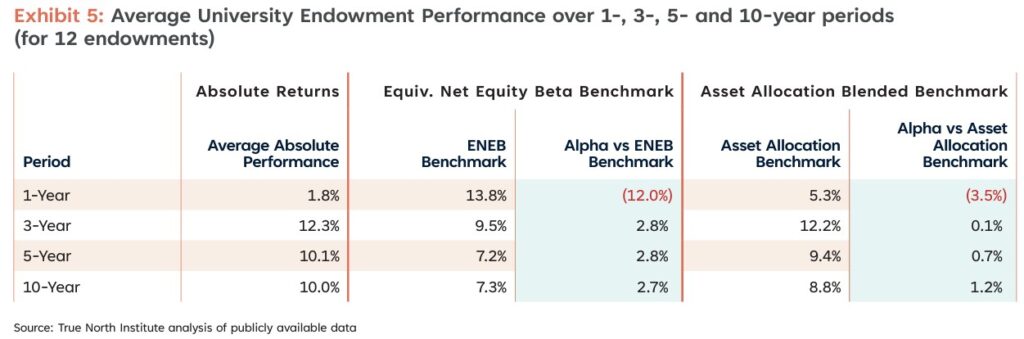

With the caveat that only the subject endowments “have all the facts about their portfolios that we wish we had,” Miranda and Hurdle used what information was publicly available to estimate the approximate alpha for each of the institutions. Outperformance was measured against two benchmarks: “equivalent net equity beta,” an investible benchmark which gives endowments credit for allocations to illiquid asset classes — AKA the illiquidity premium — and an asset allocation benchmark, a blended set of asset class indices’ performance weighted by the asset allocation of the endowment in each year.

Over the 10-year period ending in June 2023, the cohort averaged 2.7% alpha versus the equity beta benchmark, a figure that remained fairly constant for the 5-year and 3-year timeframes. (While the 1-year performance was much worse, plummeting to -12%, Miranda and Hurdle noted that this was “no cause for alarm, as it was a short period where public equities significantly outperformed private equity and venture capital, and largely reflects time lags between when private and public equities are marked.”)

Comparing the endowments to the asset allocation benchmark, however, resulted in a less rosy picture. The cohort averaged 1.2% alpha over the 10-year period, a figure which shrank to 0.7% over the last 5 years and 0.1% over 3 years.

“Despite . . . 10-to-20-year time frames being the most relevant, we cannot ignore this disturbing trend,” Miranda and Hurdle wrote.

The implication, according to the True North analysis, is that endowment outperformance is primarily driven by large allocations to illiquid assets (but mostly private equity). The problem: Miranda and Hurdle “do not assume that private equity and venture capital will deliver the same level or consistency of returns in the future,” thanks to the rising cost of debt due to higher interest rates.

“Alpha of 0.7% over 5 years, and near zero alpha in the last three years would be concerning for any institutional investor,” they wrote. “There is nothing to say that this situation is confined to this universe of large university endowments. Based on our tracking of numerous large pensions and sovereign wealth funds, we expect this is not a story isolated to large U.S. endowments.

“These endowments have some of the largest, most capable and long-tenured in-house investments teams in the institutional investment world. These teams are typically supported by an investment committee comprised of a ‘who’s who’ of leading investment professionals who, in many cases, have a passion for helping their alma-maters, and devote significant time and effort. If these teams are experiencing these challenges, they will not be alone.”

Amy Whyte, The Allocator

21 May 2024