Public Equity

Transitioning Titan Stories

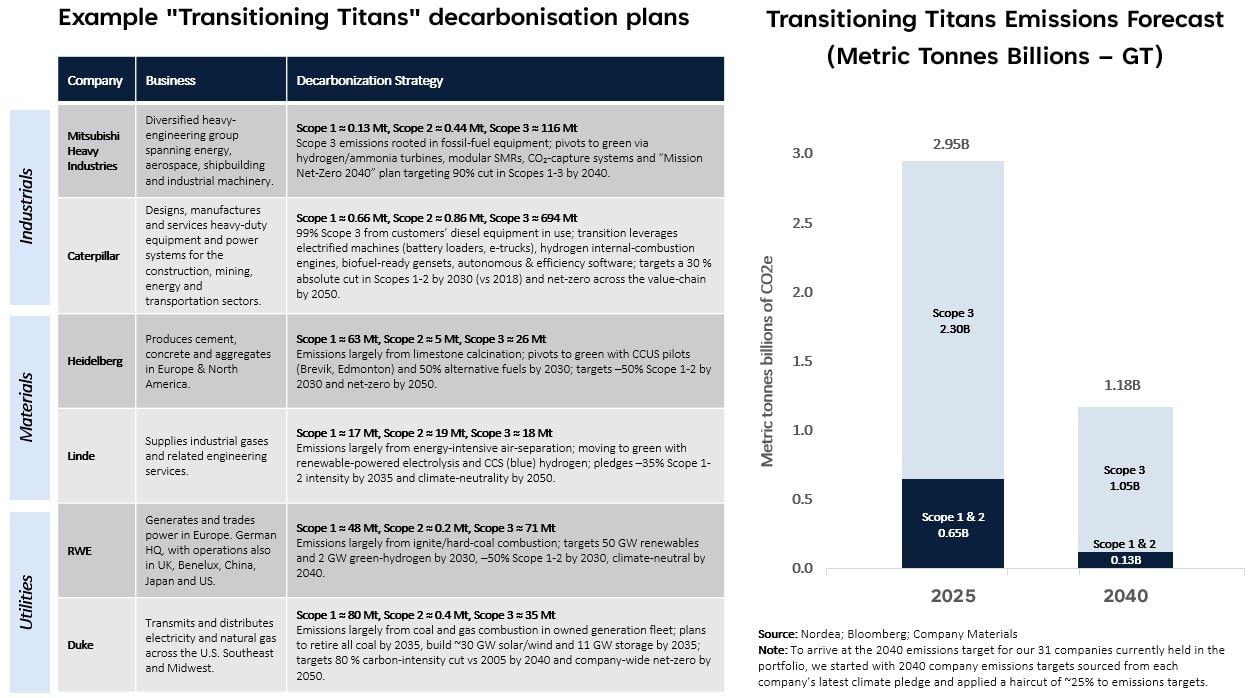

Here are six examples of large companies leading their sectors decarbonization efforts by making large investments in low carbon technology, processes and products. The 31 companies in the current portfolio are estimated to emit over 3 gigatons of CO2e today, and are expected to remove nearly 2 gigatons by 2040 (based on TNI’s ‘haircuts’ on the companies emissions targets).