research

Partners Capital

Intellectual Capital Library

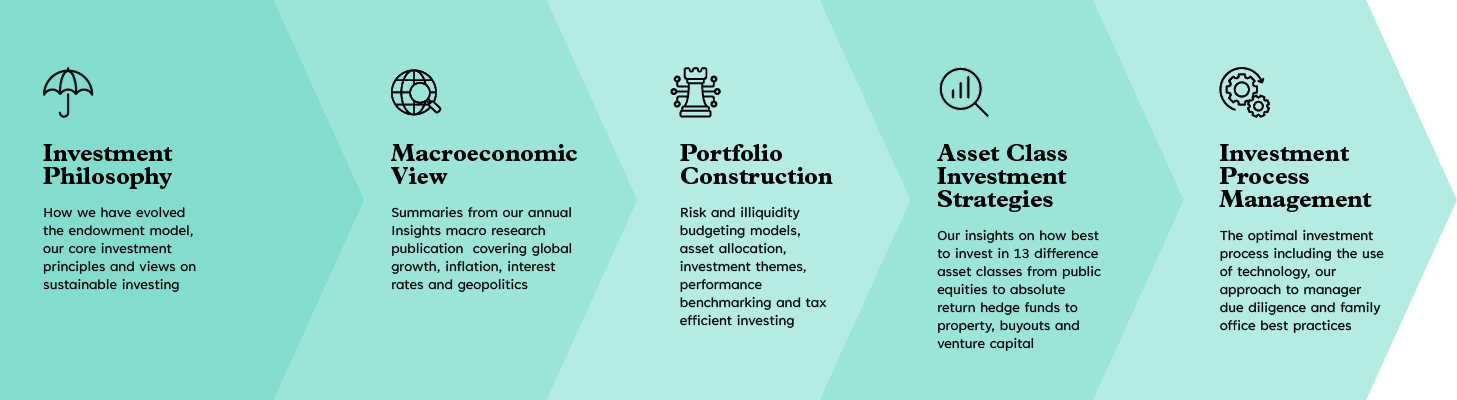

The Intellectual Capital Library at Partners Capital showcases the work that goes into delivering what is believed to be the most successful institutional investment approach. It contains the latest thinking and philosophical underpinnings of Partners Capital Risk Managed Endowment Approach.

Partners Capital Library

featured research

APRIL 2010

Asset Allocation

Partners Capital starts any discussion about portfolio construction by optimizing capital allocation across core market betas.

In this paper, Partners Capital define how any long-term investor should establish a budget or target amount of market risk for an overall portfolio.

Effective benchmarking is essential when judging the long-term performance of institutional portfolios.

Some of the largest endowments have developed successful investment strategies, but the "endowment model" is no panacea for all investors.

The best performing investment committees recognise their primary role is one of governance, not investing.

Learn how institutions can exploit their natural long-time horizons with sizeable allocations to private markets in both the equity and debt asset class.

Many active managers fail to justify their fees. Apparent outperformance is often the result of specific market risks, not manager skill