RESEARCH

Clean Hydrogen Investment Framework

The most important things that all investors need to know about clean hydrogen

There are few energy transition topics more controversial than clean hydrogen’s likely role, and it has huge investment implications, whether you are a public or private equity investor, and especially if you are a venture capital investor. For this reason, we spent the last nine months researching the most economically viable applications for green hydrogen drawing from a vast array of experts who have been deep into the topic, some for decades, and we have come to the following key conclusions:

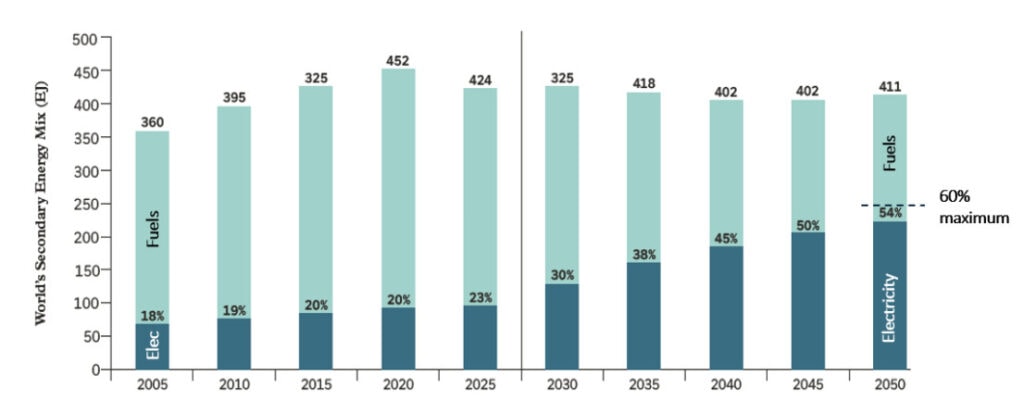

1. The theoretical need for hydrogen in the energy transition is huge. Today global secondary (final use) energy demand is about 430 exajoules, of which 22% is supplied with electricity, the rest with directly used fossil fuels. Electrification cannot replace many fuel usages, with the highest estimates forecasting that 22% can rise to 60% electricity (assuming nearly all is renewable) by 2050, leaving 40% in fossil fuels needing to be replaced with clean fuels. Biofuels are limited by the quantity of waste, land and water, leaving hydrogen as the only other potential solution for satisfying what could be as much as 35% of all energy demand.

The ambition to “electrify everything” has its limits leaving a huge potential

market for clean fuels

Source: NGFS for bar chart data; 60% maximum is Partners Capital electricity share estimate

assuming total energy demand rises to 430 Ej and electricity consumption is 72,000 TWhs in 2050.

2. For electricity generation, hydrogen is not a practical substitute in coal or natural gas power plants as carbon capture on coal and natural gas plants is likely to be lower cost. Within the 60% electricity supplied energy in 2050, most will be achieved from renewable energy (including hydro and nuclear) with battery storage, and some carbon capture on gas and coal plants. Relying on analytical input from the Clean Air Task Force, we forecast that hydrogen will be used primarily in low-capacity utilization power plants to fill gaps in electricity production against peak demand that could contribute to as much as 5% of all electricity needs.

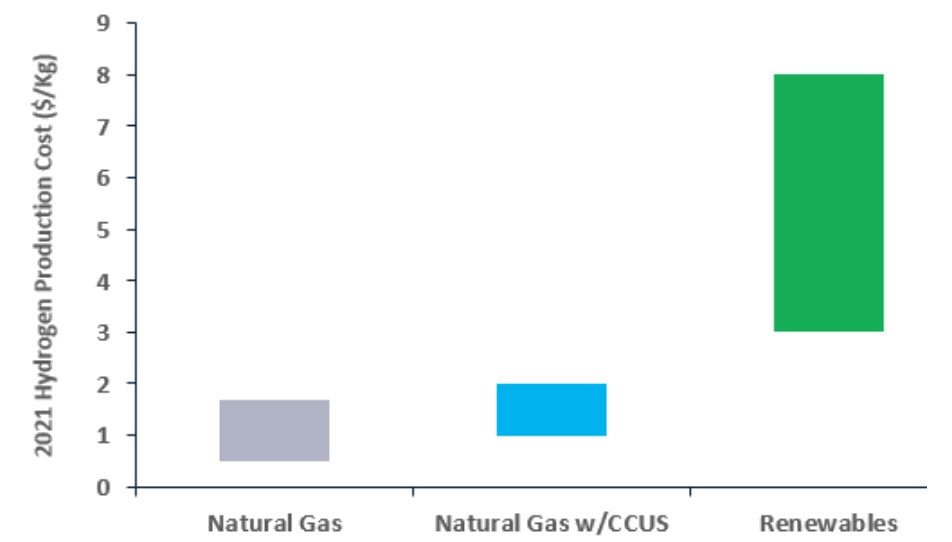

3. The future average cost of green hydrogen (from electrolyzing water to separate the H2 from the O) is, at minimum, only ever going to get down to about $3/kg, with a range from $3 to 8$/kg, depending on production and transportation costs. This is three times as expensive as the current grey hydrogen that costs between $0.50 and 1.50/kg to produce. Carbon capture from steam reforming of natural gas (i.e., blue hydrogen) is expected to get down to as low as $2/kg, still twice as expensive as the grey hydrogen used today.

Forecast range of hydrogen cost/kg for grey, blue and green hydrogen

4. Green hydrogen is hugely inefficient to produce yielding an energy output that is about 30% of the energy input. Pure hydrogen is 1/3 as dense in energy per unit of volume as natural gas. Dense gases are easier to move than less dense ones.

5. Today, there are only 700 megawatts of operating electrolysers, producing around 110,000 tonnes of green hydrogen annually. This compares to estimates of up to 600 million tonnes needed to achieve net zero by 2050 (IEA). There are 30 Mt of announced hydrogen production projects today. So we are 0.02% of the way there today, with positive momentum.

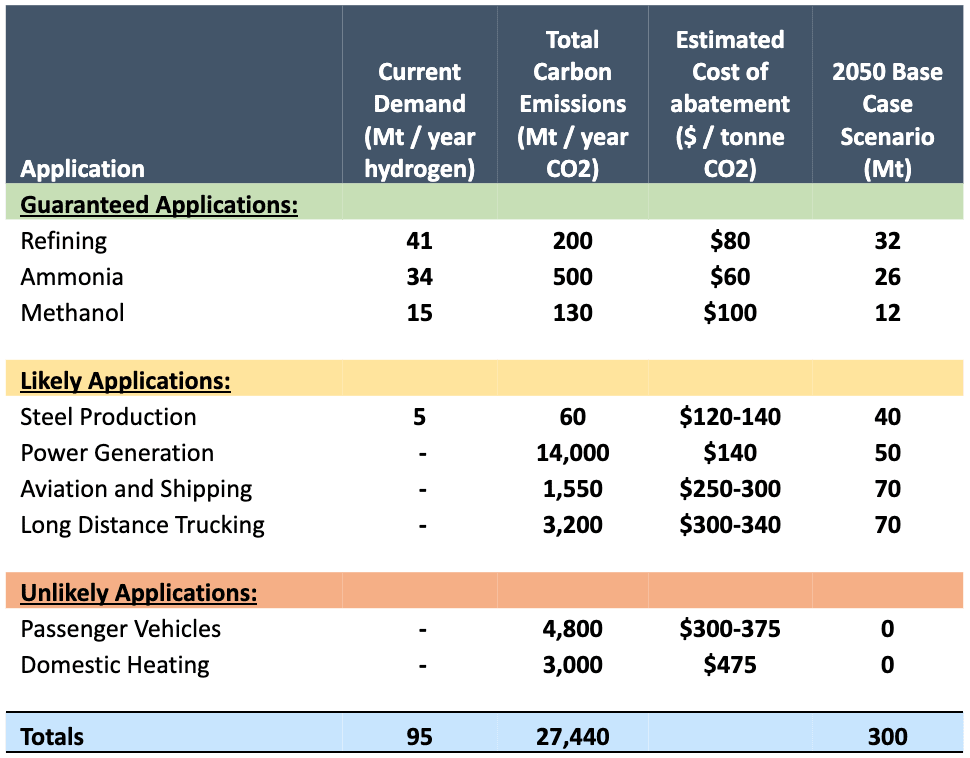

6. Based on our bottom-up analysis of each potential hydrogen application, focusing on cost competitiveness vs other alternatives (like EV batteries in long-haul trucks) and likely subsidies or other policy support applied to each potential application, we arrive at an estimate of 47 Mt of clean hydrogen demand by 2030, and 300 Mt of demand by 2050, or a 4% pa growth rate. This forecast is roughly half of the 600 Mt that many other experts estimate is required to meet net zero targets.

7. Assuming there will be significant policy support (e.g., an effective carbon tax of $100/T of emissions applied to the fossil fuel alternatives including grey hydrogen emissions, we forecast that the 95 Mt of current grey hydrogen usage will be the priority for clean hydrogen supply, closely followed by shipping, aviation and long-haul trucking. H2 in power generation will be limited to 5% of all electricity due to its high cost relative to carbon capture.

The “hydrogen ladder” showing the most to least cost-effective applications

Sources: Goldman Sachs Carbonomics 2023 for cost of abatement figures; IEA for total carbon

emissions; aviation cost of abatement is not broken out from shipping cost, so we show the same costs for both. 2050 base case scenarios from Partners Capital analysis of each application.

Investment Implications: Clean hydrogen is at such an early stage of development that it is challenging to find enough investors wanting to take the combination of technology, development, economic and offtake risk with such large, required tickets. This is why governments are involved – i.e., to kickstart the hydrogen industry with subsidies and regulations. Beyond governments, we expect that the bulk of the investment will be made by large, mostly public, companies with strategic joint-ventures to lower risk. Valuing these companies will be challenging as this sector’s decarbonisation investments will depend on government policy support and carry the risk of its level and permanence. Other than selective early-stage venture investments, we do not see a large role at this stage for private capital investing in clean hydrogen.

The whitepaper, entitled “Clean Hydrogen Investment Framework” offers investors an exhaustive assessment of the opportunities for clean hydrogen across all sectors including power generation, steel and cement production, and transportation including long-haul trucking, shipping and aviation.